William D. Gann Technical Analysis Made Truly Understandable!

We’ve been teaching investors the techniques of W.D. Gann for the past 35 years without any reference to any other analysis method. The techniques taught have been extracted from Gann's books or more importantly from his courses. From these basic tenets we’ve discovered some exciting logical extensions. We clearly state when we have introduced such an extension. It is then up to the investor to accept or reject the proposition. Over the last 35 years we have organised basic Gann principles in a logical sequence. This organisation and the initial exclusion of the more sophisticated techniques have enabled us to produce a Gann trading method which is logical and understandable to all.

These series of lessons will introduce students to this simplified approach which will transform the beginner or even seasoned trader into a profitable trading machine within a matter of months. The method can be profitably applied to all of the worlds speculative markets.

The aim of the course is to introduce the trader to a system with a disciplined and clearly defined series of decisions each constructed from conclusions extracted from a progressive series of relatively simple calculations. An important feature is that no personal judgments need be made, culminating in all analysts using this method coming to the same conclusion on the same day. This is achieved by using mathematical calculations created from what Gann termed 'Natural Law'. These rules ensure that the investor can smoothly, effortlessly and unemotionally take actions to buy, sell or hold. The investor will be able to distinguish between short, medium or long term strategies by using different sets of formulae. The method applies to all investment markets including the stock, commodity and foreign exchange markets and extends to the analysis of managed funds and even to the movement of interest rates.

As an introduction to the quality of our course we are providing this free introductory lesson which will present general rules and a specific rule of great value. The intention will be to disclose the flavour and uniqueness of our course and it's simple approach.

Essential Rule number one

Divide your capital into 10 equal parts and never risk more than 1/10th of your capital in any one trade.

Editors Comments : It follows, therefore, that with a capital base of $100,000 capital, EVERY trade made should be as close as possible to $10,000. Traders should not make judgements as to how strong a particular trade is compared with others. The rule will guard against investing heavily in a trade that goes wrong and investing a small amount in a big winner. This avoids the possibility of suffering large losses which are only partly offset by small profits. The object should be to experience small losses which are more than offset by large profits.

By using this rule the disastrous policy of investing more and more as markets rise is also avoided. Have you ever wondered why speculators suffer massive losses at tops of markets after a bull market has lasted a decade or so? Surely after such a good period plenty of profits should have accumulated to deal with any sudden losses? The problem is that speculators invest very little at market lows when their confidence is at a low ebb. As the market soars their confidence and greed grow encouraging them to invest more and more as the markets soar to new highs.

To summarise : Spread your risk equally. If you are not absolutely convinced of the wisdom of effecting a trade just don't trade. Never compromise by reducing the amount you invest. The trade is either worth the risk or it isn't, If it isn't don't trade.

Essential Rule number two - Always use a stop loss point

Editors comment : (a stop loss point is the price where a trade should be exited either with a profit or a loss) this exit point should be determined BEFORE a trade is opened. This allows the investor to assess the maximum loss he is likely to suffer. The maximum amount of loss should be for an amount with which the investor feels comfortable. When a loss is ENJOYED it should be likened to the payment of an insurance premium which ensures that a catastrophe is avoided. It might surprise you to hear us say that losses should be enjoyed.

The fact is that losses are an integral part of a trader’s life. Once it is accepted that to accept small losses is not a cardinal sin the trader is well on the way to success. Losses can be likened to unsuccessful presentations given by an accomplished salesman. The salesman knows he must accept a number of negative responses to his sales efforts before he hits the jackpot. The experienced salesmen welcome these refusals. He will know his success rate and after each unsuccessful presentation he will be nearer to that next sale. Similarly once a trader has established his success ratio he can also be happy to record a loss as a positive event rather than an emotional disaster. He will be nearer to the thrill of those juicy profits.

Essential Rule number three - Never, under any circumstances, overtrade.

Editors comment : Many inexperienced investors conclude that investment is a simple and easy way to make a large amount of money in a very short period of time. Experienced traders know that this is untrue. Early in a trader's career the temptation to overtrade is almost unstoppable. The extraordinary effectiveness of the modern day marketing methods in the financial services industry can be overwhelming. This especially applies at the tops of Bull Markets. The continual exposure to offers of unrepeatable profitable opportunities is almost irresistible. The pressure on investors to overtrade is immense yet it must be avoided at all costs. One way of achieving this goal is to understand that fortunes are not made at tops of markets but at the bottoms of markets.

Historic opportunities occur after a market has fallen over a period of years with a fall usually of horrendous magnitude. At such times, financial marketing is almost defunct and is noticeable only by its absence. When adverts are few and you can't see a smiling face on those TV channels then the time to buy is nigh.

The only time you will get away with overtrading is when the pressures to buy are non existent and life looks extremely bleak. Therefore, avoid overtrading by looking at facts and ignoring opinion. In reality, facts are always hard to come by whilst opinion is constantly within earshot. You have to ferret out facts but you will have opinion thrust upon you. When opinion dries up, then is the time to look for the facts.

In all, there are 21 Gann trading rules. We have introduced three of them.

There are three main components of this Gann course.

They are :

- 1. Money Management

- 2. Psychology

- 3. Technical

Having taken a glance at the first two components now is the time to have a quick peek at a technical feature.

The Magic of the G1 support level The objective of the technical section is to enable students to identify future tops and bottoms of markets weeks, months or even years ahead of their ultimate formation.

One of the most important discoveries made by Gann was that there is a mathematical relationship between past tops and bottoms and future tops and bottoms. If this is a reality, then by isolating past turning points, future tops and bottoms levels can be identified well in advance.

To establish these levels there are a number of calculations to be made. The most important calculation is to isolate what we term the G1 level. G1 is purely a code we use to save space on our software program and computer graphical presentations. The G1 level is Gann's most important level. The G2 level is the 2nd most important level etc.

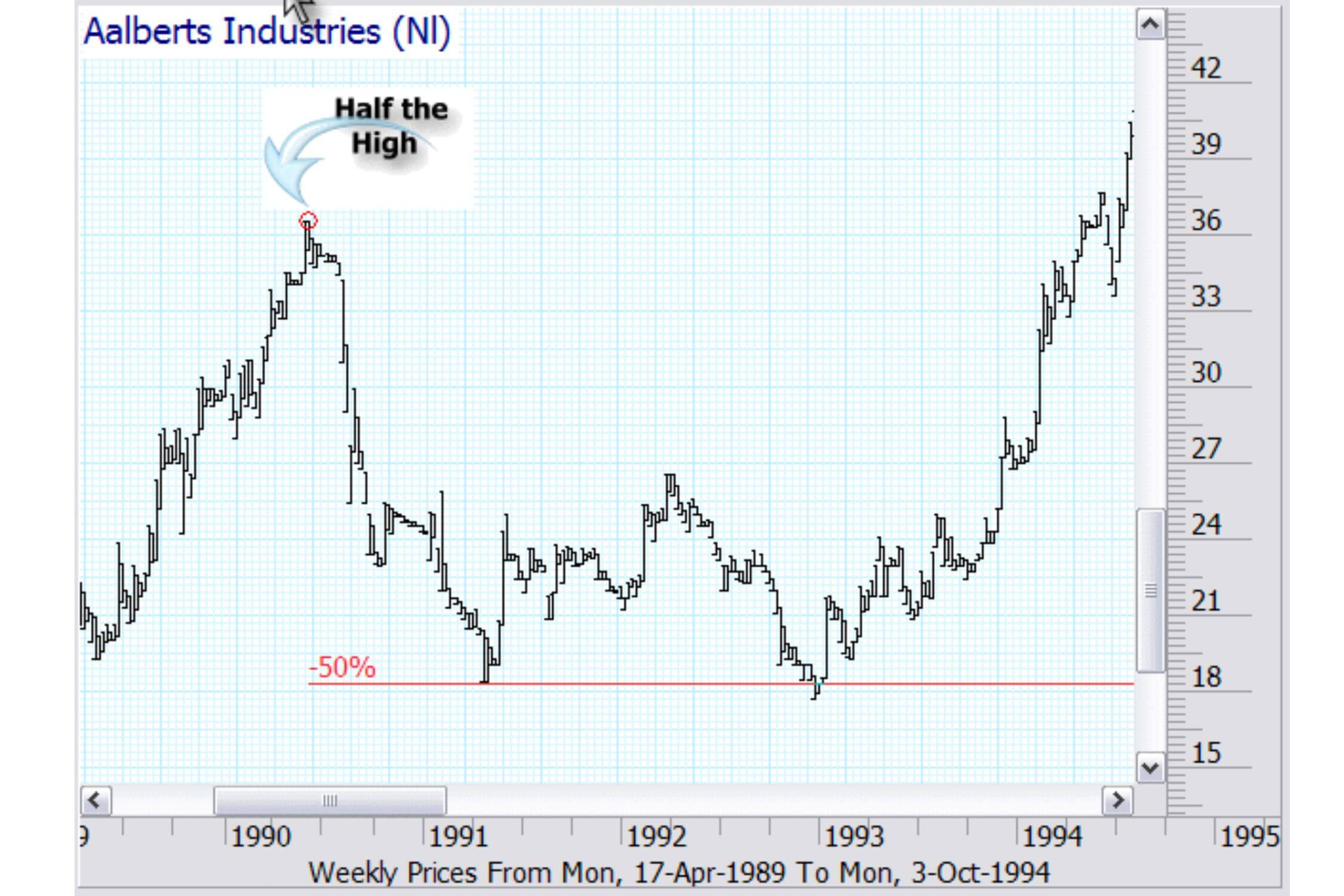

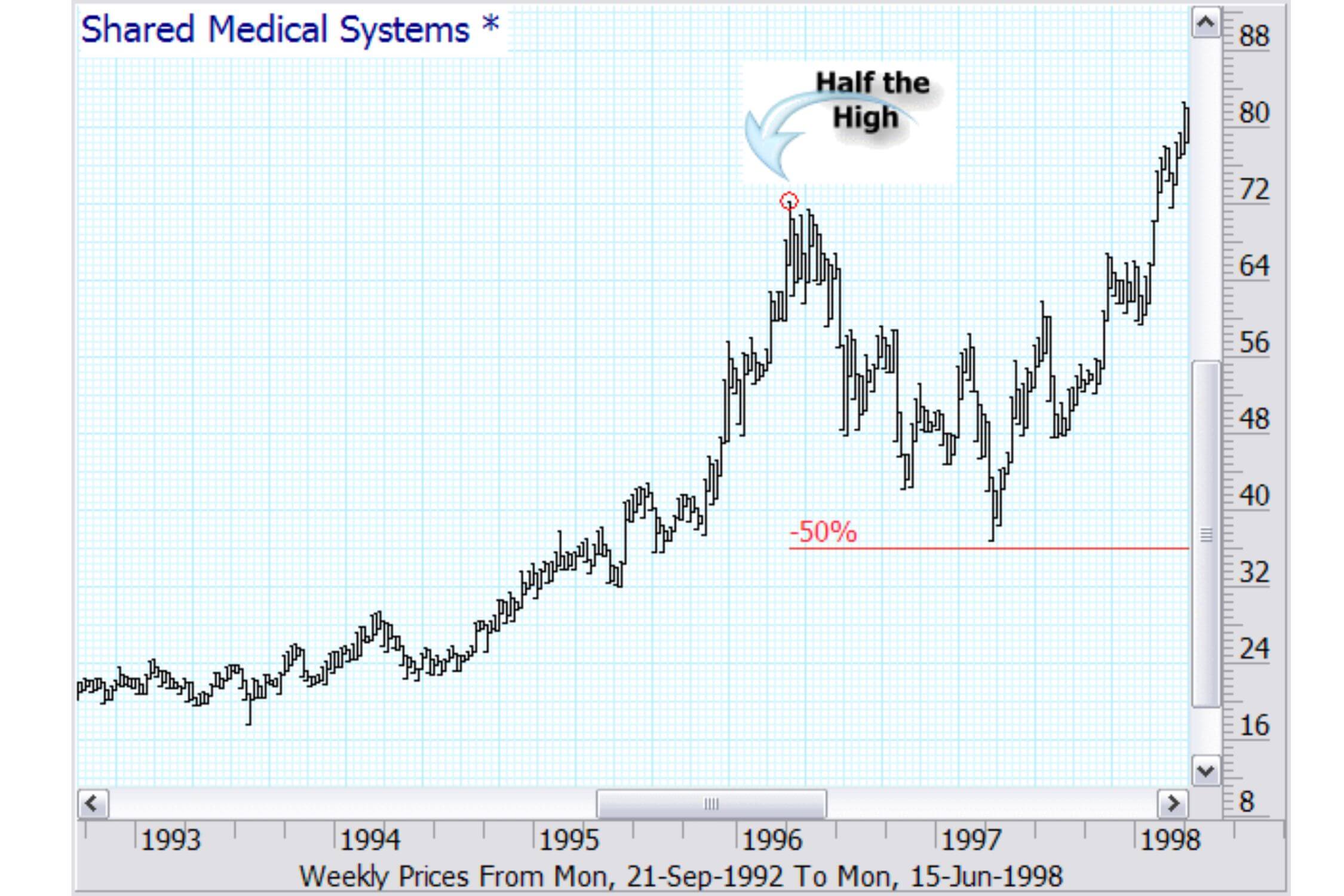

To obtain this G1 level all you have to do is divide the historical high by 2.

The G1 level is important because it is the balancing point of all the prices traded during the investment's lifetime. The first hit of the G1 level is the safest to use.

The success of the few other methods that created some interest seemed to depend upon the judgement of the individual investor. An example would be the Elliott Wave Theory where different interpretations are common place. A further disadvantage of most was that they were laggard in nature, whilst with Gann the investor is often able to glimpse into the future which allows him to plan ahead with confidence.

It was also noted that most vendors of investment methods rarely seemed to have made profits themselves....Gann did! Furthermore an unsatisfactory 5 year back checking period seems to be the norm. As for ourselves, we believe a 60 year period is the absolute minimum period as such a check encapsulates the long term economic inflation/deflation cycles. You may think this is unreasonable but W.D. Gann spent a whole year in the British Museum where he accumulated Wheat prices going back to the 13th Century. He then applied his rules of natural law and surprise, surprise each century gave weight to his theory. Now that is checking for you! As they say genius is 10% inspiration and 90% perspiration. Gann went to great lengths to prove the point.

In support of the G1 level:- Here are a number of examples which illustrate the effectiveness of this simple calculation.

Stock Market Indices

In 1987 all the world's stock markets suffered savage falls. Yet despite the ferocity of the collapse the markets which reached the G1 level, and there were more did than didn't, were arrested exactly at 50% from their extreme highs. The markets that didn’t recover at the G1 level just ever fell that far. For instance, the Dow's fall was contained by the G2 level which is a little higher ........ but more of this in a future lessons.

Here are a few examples showing the effect of the G1 level in isolating the lows of 1987 and the following rise. The way to calculate the tops will be explained in subsequent lessons.

Australia Metals & Minerals and Malaysia are two markets which are now at or near the G1 level. Observe what happens at these important points. They will probably rise from here. If they do not hold here then the markets will be in serious position. Falls will almost certainly then fall to 50% of the G1 level. This will be fully explained in future lessons.

Japanese market

The Japanese market has suffered badly since January 1990, yet a belief in the importance of the G1 level would have provided an excellent opportunity to make a healthy profit of over 40% in October 1990. There are always healthy profits by 'buying' shares in Bear markets for those traders who understand how the markets really work. For instance, Gann in November of 1929 made a substantial 50% profit by using the G1 level at 194. The extreme 1929 high was 388. The simple division of 2 just after the Wall Street bull market topped out in 1929 isolated the opportunity well in advance. There was a 10 weeks period for the trader to steel himself to buy. Coupled with that rarest of gifts 'patience' the decision to buy is made possible for a Gann believer as belatedly others run for the exits just before the market bottoms. Coupled with that rarest of gifts 'patience' the decision to buy is made possible for a Gann believer as others belatedly run for the exists just before the market bottoms out. No Gann student, with discipline, should never have this problem.

The Gold Market

Gold Bullion and it's associated markets have had a hard time over the last decade since it spiked. However, as we have seen with Japan, the G1 level presented a glorious opportunity in the South African Gold Mines market in 1995. By calculating the G1 level and using that greatest of investment virtues 'patience' a substantial profit of 50% would have been enjoyed. This buying level could have been calculated at least 12 months before this opportunity arose. This provides plenty of time to contemplate and prepare for this G1 signal ... pure Gann magic!

UK Shares

A look at United Biscuits in 1992 is a wonderful testament of the effectiveness of the G1 level. How do a fundamentalist explain such actions?

A Few US Shares

Bank of America is a great example in the US market. By acting on a 50% fall from the extreme high in 1990 a $9 purchase would have grown to $81! (to find these two examples we checked out just 7 US shares)

A Few Japanese Shares

Hitachi fell to the G1 level for the first time in November 1990 which arrested the fall and provided an opportunity of a 25% profit in a few weeks before it continued its fall. Sumitimo illustrates the use of the G1 level as a place to take profits. A trader picking up shares in late 1990 would have been warned of trouble in the 2500 G1 area.

A Few European Shares

The French share Pernod enjoyed a substantial rise form its G1 base in 1997. Skis Rossignal enjoyed a similar experience in 1995 when it zoomed from the G1 level. The Norwegian shipping line Norsk Hydro commenced it massive rise from the G1 in 1992. Buying Kredietbank on its 1987 G1 level would have gave one a smile.

Warning : A little knowledge is a dangerous thing. The G1 level is only one piece of a jig saw puzzle all be it an important one. Do not purely trade on this indicator. Learn the other pieces before trading.